Key to Lasting Wealth: Smart Bankroll Management for Gamblers

- Category: Pics |

- 25 Sep, 2024 |

- Views: 552 |

However, without proper bankroll management, most gamblers end up losing their entire bankroll. Developing financial discipline and self-control are crucial to managing risk and securing long-term profits at 7Bit Casino. In this article, we provide pro tips for constructing an intelligent bankroll strategy tailored to your personal finances and risk tolerance. Follow our advice below to set yourself up for lasting wealth through smart gambling.

Determine Your Bankroll Based on Income and Bills

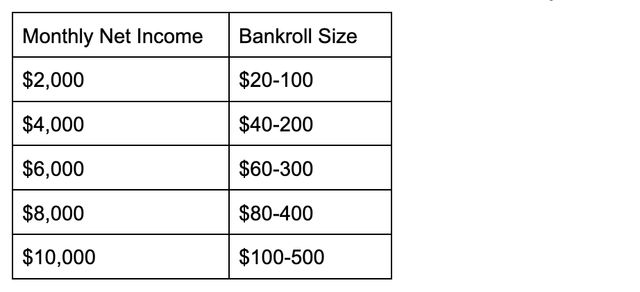

The foundation of a sound bankroll strategy is aligning the size of your bankroll with your financial situation outside of gambling. As a general rule, you should allocate 1-5% of your net income after paying all necessary bills and expenses to gambling. For example:

• If your monthly net income is $4,000, allocate $40-200 for gambling

• If your monthly net income is $10,000, allocate $100-500 for gambling

This ensures that even with significant losses, you won’t compromise your ability to afford basic living essentials and financial obligations. It also prevents you from betting more than you can afford to lose, protecting your overall financial health.

Recommended Bankroll Size Based on Monthly Net Income

Set a Loss Limit Based on Bankroll Size

Once you’ve determined the total size of your bankroll, establish a loss limit for each gambling session based on that number. As a general guideline, budget to lose no more than 10-20% of your total bankroll in one session.

For example, if your bankroll is $500, your loss limit per session should be $50-100. If you lose $100 during a poker game or day at the race track, walk away and stop gambling for the day, even if you still want to keep playing. This prevents you from panicking and making risky bets trying to win back losses in the same session.

By capping your losses relative to your entire bankroll, you ensure you’ll have money left to gamble another day. This makes your bankroll last longer and gives you more opportunities to profit over time.

Use Proper Bet Sizing Relative to Bankroll

In addition to loss limits per session, you should adhere to bet sizing standards relative to your overall bankroll size. As a general rule of thumb:

• Make no single bet over 1-2% of your total bankroll

• Make no daily total of bets over 5% of your total bankroll

For example, if your allocated bankroll is $1,000, you would make no single bet over $10-20, and place no more than $50 in total bets per day. This conservative approach minimizes the risk from any given bet or gambling day. Even if you lose the maximum on a few big bets or hit a bad losing streak, you won’t completely drain your bankroll.

Proper bet sizing is key to longevity. It helps you endure normal ups and downs without wiping out the bankroll you depend on to remain in action over the long run.

Use Winnings to Grow Bankroll Over Time

As you profit, resist the urge to withdraw all winnings or increase your bet size substantially. Instead, use a percentage of any profits to incrementally increase your bankroll over time. This compounds your wealth and allows you to gradually place higher value bets as the bankroll grows.

For example, let’s say you originally set a bankroll of $500 with a $50 max bet per session based on a 10% loss limit. If you grow your bankroll to $750, you can increase your loss limit per session to $75 (10% of $750) and maximum bet per session to $75 rather than $50. This enables you to scale up bets--and potential winnings--as the bankroll increases.

By locking some profits back into your bankroll, you set yourself up for exponentially higher earnings long-term. Your bankroll--and with it, your betting power and profit ceiling--compounds over time.

Review and Adjust Strategies Periodically

Finally, review your bankroll management strategy every 6-12 months and make any necessary adjustments. Factors like income, bills, and risk tolerance can change over time. You may be able to afford allocating more money to gambling than you could originally. Or life changes might demand reducing your bankroll to free up cash flow elsewhere.

Continually optimizing your plan relative to shifting financial realities off the table helps you fine-tune your path to lasting profits.

Conclusion

Skilled bankroll management separates recreational gamblers from profitable professionals. By aligning your bankroll size with your overall finances, capping losses per session, using proper bet sizing, reinvesting profits to grow your bankroll, and periodically reviewing your plan, you set yourself up for sustainable wealth-building through gambling over a lifetime. Rather than a series of hit-or-miss bets, view gambling as a long-term portfolio and invest in it wisely. Your future self will thank you.