Understanding How Gambling Impacts Your Taxes

- Category: Pics |

- 30 Aug, 2024 |

- Views: 445 |

Gambling activity, whether done recreationally or professionally, can have tax implications that are important to understand. Gambling winnings are fully taxable and must be reported to the IRS. At the same time, gambling losses can be deducted to offset winnings. Putting some thought into record-keeping and strategy around gambling taxation can enable you to optimize your tax position.

Tracking Gambling Activity for Tax Reporting

Carefully tracking details around both gambling winnings at PlayZilla and losses is crucial for accurate tax reporting:

• Winnings - Gambling winnings from all sources must be reported as “Other Income” on your tax return if you have net earnings of over $600 in a calendar year. Common sources of taxable gambling income include lottery or game show prizes, casino earnings, sports betting proceeds, and more. If you do not receive a Form W-2G detailing your gambling winnings, you are still responsible for self-reporting.

• Losses - Gambling losses can be deducted as an “Other Itemized Deduction,” but cannot exceed the amount of gambling income you report. So detailed records should be kept on losing bets, lottery tickets, casino losses, and other gambling-related deductions.

• Record-Keeping - Save documentation on all gambling activity such as receipts, tickets, statements, logbooks, etc. Also track details like dates, locations, amounts won/lost, and type of gambling activity. Records should be thorough and organized in case of an audit.

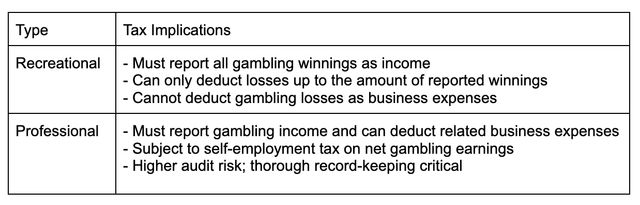

Key Tax Implications for Recreational vs Professional Gamblers

The extent of your gambling activity also has an impact from a tax perspective:

As shown, professional gamblers take part in gambling activity as a trade or business, while recreational gamblers gamble purely for personal entertainment. These classifications lead to key differences in how gambling activity is handled tax-wise.

Strategies to Leverage Gambling Taxation Rules

Within the https://slotspeak.com/blast-off-to-cosmic-cash-an-online-slot-thats-out-of-this-world/ taxation framework, there are some strategic steps you can take to optimize your tax position:

1. Offset Winnings with Losses - Be sure to claim allowable gambling loss deductions up to the full amount of your reported gambling winnings each year. This can completely offset tax owed on the winnings.

2. Show Gambling Activity as a Hobby - Even if you gamble frequently, positioning your gambling as recreational instead of professional can provide tax advantages in some cases.

3. Contribute Losses to an IRA - Gambling losses that cannot be claimed in the current tax year can sometimes be deducted if contributed to certain retirement accounts.

4. Claim Business Expenses - If you do operate as a professional gambler, ensure you track and claim all allowable gambling-related business expenses.

Manage Audit Risk - Since gambling wins/losses can be complex to track, maintain meticulous documentation and consider consulting a tax professional to minimize audit risk.

Bottom Line

With proper strategies around record-keeping, loss-tracking, and positioning of your gambling activity, you can thoughtfully manage the related tax implications. Since gambling taxation rules do allow favorable deductions for losses and business expenses, ensure you are fully leveraging the opportunities within the regulatory framework. As gambling activity ramps up, a tax professional can provide helpful guidance as well.