Hidden Tax Traps of Online Gambling Winnings

- Category: Pics |

- 28 Jun, 2024 |

- Views: 475 |

The lure of easy money and big jackpot wins makes online gambling highly popular. However, what many players overlook are the tax implications of their gambling winnings? As with any other form of income, you must report online gambling winnings to the IRS and pay taxes. However, confusing and strict tax rules around gambling often trip players up, creating tax nightmares. This article breaks down the key tax issues around online gambling winnings at Retro Bet Casino and tips to avoid trouble with the IRS.

Taxability of Online Gambling Winnings

All gambling winnings, whether from land-based or online casinos, sports betting, poker, or other games, count as taxable income in the eyes of the IRS. This includes not just the big jackpot wins but even small daily wins. So if Lady Luck smiles upon you when playing Internet slots or betting on sports, be prepared to share your good fortune with Uncle Sam.

The only exception is if your total gambling losses for the year exceed your total gambling winnings. We’ll explore gambling losses more a little later.

Reporting Thresholds

You must report and pay taxes on all your online or land-based gambling winnings. However, whether the gambling operator reports your winnings to the IRS differs based on specific thresholds.

Operators such as online casinos and sportsbooks must issue an IRS Form W-2G reporting any winnings of:

• $600 or more at a horse track or off-track betting facility

• $600 or more in gambling winnings where the payout is at least 300 times the amount of the wager

• $1,200 or more from bingo or roulette online website

• $1,500 or more in proceeds from keno

More than $5,000 in winnings from other gambling activities, like poker tournaments

Additionally, if the payout does not meet the above threshold criteria but your total gambling winnings for the year from that operator exceed $600, the operator must also issue you a Form W-2G.

If you do not provide accurate taxpayer identification information like social security number to the operator, they may have to withhold income tax of up to 24% of your winnings.

Tax Forms for Reporting Gambling Income If you are serious about online or land-based gambling, get familiar with the following IRS tax forms related to reporting gambling income:

IRS Form W-2G: Certain Gambling Winnings

Operators like casinos, sportsbooks, or poker sites issue this form when reporting your gambling winnings to the IRS if you meet the reporting thresholds. It shows how much you won and how much tax was withheld.

IRS Form 5754: Statement by Person Receiving Gambling Winnings

If you share a big jackpot with others, the payer uses Form 5754 to report shares of the winnings for each winner instead of issuing multiple W-2Gs.

IRS Schedule 1: Additional Income and Adjustments to Income You must use Schedule 1 to report all your gambling winnings and losses that operators have not reported on Form W-2G.

IRS Form 1040: U.S. Individual Income Tax Return

You must transfer the numbers from the above forms and schedules onto Form 1040 to file along with your regular tax return.

Calculating Taxes on Gambling Winnings

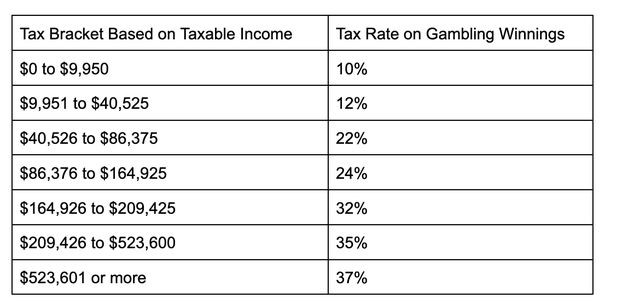

In most cases, gambling winnings get treated as “other income” on your tax return. The tax rate you pay depends on your total annual income and income tax bracket:

For example, if you are in the 24% tax bracket and win $5,000 playing online slots, you owe $5,000 x 24% = $1,200 in federal taxes on the winnings. Add to this any state taxes.

Can You Deduct Gambling Losses Against Winnings?

The tax law allows you to deduct gambling losses up to the amount of your total gambling winnings as an itemized deduction. However, you cannot reduce your taxable income below zero with gambling losses. Nor can you carry forward net losses to future tax years.

To claim gambling losses, keep detailed records like casino statements, lottery tickets, racing stubs, and receipts as evidence in case of an IRS audit. Reporting your gambling income and losses accurately lowers audit risk.

Tax Tips for Online Gamblers

Here are some quick tips to help manage taxes on your online or in-person gambling:

• Keep records of all gambling winnings and losses.

• Report all gambling winnings as “other income” on your tax return.

• Deduct gambling losses up to the amount of winnings as itemized deductions.

• Make estimated tax payments on large gambling wins to avoid penalties for underpayment.

• Withhold taxes upfront on large jackpots before leaving the casino.

Ignoring the tax obligations around gambling winnings can create costly problems with the IRS in terms of penalties, fees, and audits. But some smart planning goes a long way in softening the tax hit so you enjoy more of your hard-won gambling profits.