Investing in Cryptocurrencies: Tips and Strategies

- Category: Pics |

- 27 Jun, 2024 |

- Views: 311 |

Cryptocurrencies have surged into the mainstream financial landscape, capturing the imagination of investors worldwide.

What started out as a niche concept has grown into a thriving market worth billions, presenting unprecedented opportunities and risks alike.

So, how can one navigate them wisely and invest effectively?

Investing in crypto requires a nuanced approach, blending innovation with caution to navigate this money-related industry effectively.

Understanding what is right for you will help you choose the right strategy and the latest tips for effective investing. First off, let's look at who these pieces of advice are valuable for.

Who Needs Information About Crypto Investing?

In today’s digital age, the allure of digital assets has attracted a diverse audience beyond traditional investors.

All the benefits from information about investing in this kind of an asset will shed light on the wide-ranging appeal and practical applications of this emerging asset class.

Individuals

Individuals looking for alternative investment avenues beyond traditional markets frequently gravitate towards cryptocurrencies. They are attracted by the promise of significant returns, access to global markets, and the decentralized structure of blockchain technology.

Whether experienced investors or newcomers, grasping the intricacies of crypto investing enables them to navigate this dynamic and swiftly changing environment effectively.

Financial Professionals

Financial advisors, portfolio managers, and analysts increasingly recognize the importance of knowledge. They need to stay informed to provide accurate guidance to clients exploring crypto investments.

Market trends, risk factors, and regulatory developments enables these professionals to offer well-informed advice and manage diversified portfolios effectively.

One notable example of a famous financier who made substantial investments and achieved significant gains is Paul Tudor Jones. His endorsement of Bitcoin in May 2020 coincided with a period of significant price appreciation for the cryptocurrency, where Bitcoin’s value surged from around $7,000 to over $10,000 in the weeks following his announcement.

Tech Enthusiasts and Innovators

Cryptoassets appeal to tech enthusiasts and innovators intrigued by blockchain technology’s disruptive potential. They seek not only investment opportunities but also opportunities to participate in projects driving technological innovation.

Сryptocurrency investing empowers them to support and contribute to decentralized applications, token economies, and digital ecosystems.

Entrepreneurs and Business Leaders

Entrepreneurs and business leaders exploring new avenues for fundraising, payment solutions, or blockchain-based business models benefit greatly from investments.

Thus, the knowledge on investing is essential for making informed strategic decisions whether launching

1. initial coin offerings (ICOs),

2. exploring decentralized finance (DeFi) applications, or

3. integrating blockchain technology into their operations.

Everyday Consumers

Even everyday consumers, whether using crypto for online transactions, remittances, or as a store of value, benefit from understanding the basics of investing.

Awareness of security practices, wallet management, and market trends ensure safe and informed participation in the digital economy.

Crypto Investment Guide

Investing entails buying digital assets with fiat money or other cryptoassets. Unlike traditional assets such as equities and bonds, cryptocurrencies are based on decentralized networks that employ blockchain technology.

This decentralized structure eliminates intermediaries, resulting in transparency and perhaps larger returns, but with increased volatility.

Tips for Investing in Crypto

1. Extensive research is required before investing. This includes understanding the principles of blockchain technology, the specific cryptocurrency, its application, and market movements.

2. Diversify Your Portfolio: Spread your assets across many cryptocurrencies to reduce risk. Diversification helps to balance possible losses against gains from other assets.

3. Stay informed: Markets are extremely volatile and are impacted by news and regulatory changes. Stay informed so that you may make prompt judgments.

4. Secure your investments: Use trustworthy exchanges and wallets to preserve your assets from cyber dangers and breaches.

Effective Strategies for Cryptocurrency Investment

1. Long-Term Holding: Adopt a buy-and-hold strategy with strong fundamentals and potential long-term growth. This approach capitalizes on market cycles and reduces the impact of short-term volatility.

2. Technical Analysis: Utilize technical indicators and chart patterns to identify entry and exit points. Technical analysis helps in timing trades and maximizing profits.

3. Fundamental Analysis: Evaluate the underlying technology, team, and adoption rate of cryptocurrencies. Investing based on strong fundamentals can lead to sustainable growth.

4. Risk Management: Set clear hunch goals and allocate only a portion of your portfolio to cryptocurrencies. Use stop-loss orders and diversification to manage risk effectively.

Real-life Example of Crypto Investment Strategy

Infusing in Bitcoin (BTC) has historically been attractive for several reasons.

In its early years, Bitcoin experienced significant price appreciation from fractions of a cent to over $1,000 by the end of 2013, marking its first major price surge.

The year 2017 was a watershed moment for Bitcoin as its price surged to nearly $20,000 by December. Bitcoin surged again in late 2020 and early 2021, reaching new all-time highs above $60,000.

Based on the tips provided above, there are some more reasons to imbue in BTC in 2024:

• Robust trading volumes across global exchanges

• Growing acceptance of Bitcoin by mainstream financial institutions, payment processors, and corporations

• It supports liquidity and investor confidence.

In any case, it’s significant to consider the correct ways of investing. Scroll down to find out more.

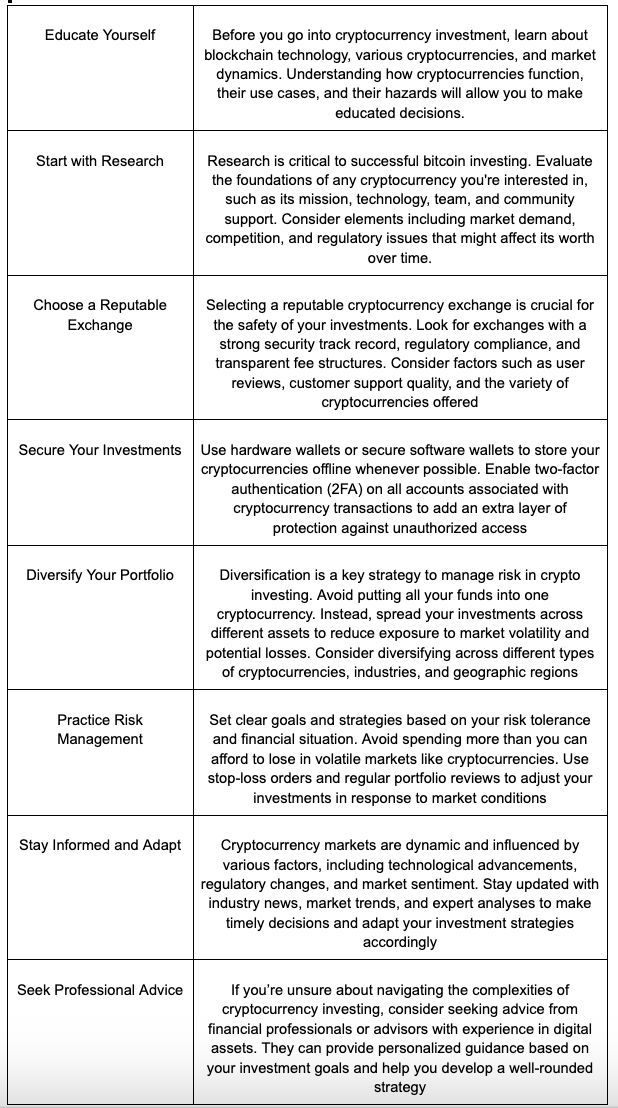

What Is the Correct and Safe Way to Ingrain in Cryptocurrency?

Investing in cryptocurrencies may be both thrilling and profitable, but it necessitates a cautious strategy to reduce risks and maximise possible rewards.

Consider the following instructions for managing the bitcoin market safely and effectively:

Conclusion

Financiers can navigate the volatility and capitalize on opportunities in this evolving space by considering the market dynamics, conducting thorough research, and implementing sound strategies.

A seasoned financier or new to the field, staying informed and adapting to market changes will be key to successful dealing with cryptocurrency.