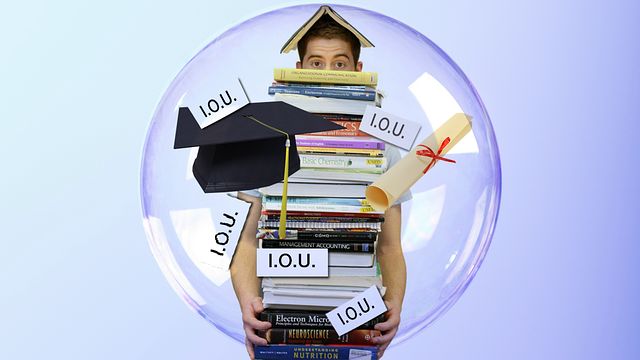

Top 7 Reasons Students Go Into Debt During School

- Category: Pics |

- 17 Nov, 2020 |

- Views: 1393 |

The student debt crisis is becoming too big to ignore. This elephant in the room is impossible for anyone to reasonably expect to stop, and it shows no signs of slowing. We're not here to talk about the causes, like government policy or the history of the academic system, but we need to discuss why it's so important. In particular, how students are getting themselves stuck in this vicious debt cycle. Another part of financial literacy that's sorely lacking for students is their investing and saving skills. There is a lot of research that shows how teaching kids good money habits early is extremely important and beneficial in order for them to effectively manage their own finances later on.

Students are finding themselves barely able to keep up with the world around them in a financial sense, and it's easy to see why - rising tuition costs, the rising cost of living, rent hikes, and all manners of major changes that are out of their control. With all of this happening around them, there are still factors at play that make students responsible for their own actions. Here are the top 7 reasons why students put themselves in debt or exacerbate their financial problems during their time in academics.

Overspending with credit cards

Credit cards can either be a blessing or a curse, depending on who's wielding it. While these cards allow us more freedom for purchases and can help us cover costs on something without the need to pay the fees upfront, it shouldn't be treated as free money. Too many students, and people in general for that matter, see credit cards as free money until their minimum monthly payments come back to haunt them. When using a credit card, students should know to only use it for recurring billing to help build credit in a responsible manner and immediately pay for any credit card purchases to avoid interest rates.

No budgeting experience

Blaming students for not having much budgeting experience would be disingenuous, so this isn't an attempt to smear their knowledge of finances. Schools and parents should have been teaching kids these fundamental life cycles at a younger age, but nothing is perfect, so they need to find knowledge on it where and when they can, and sooner rather than later. Using resources at https://www.universityherald.com/articles/77421/20201007/creating-a-student-budget.htm, students can see how easy it is to learn the basics of monetary budgeting. It's not hard to get proficient in saving money, and knowing how to spend money on necessities like groceries, gas, or school supplies will be carried into their adult lives.

Student loans

Not everyone can afford to send their kid off to college, not everyone is able to work enough to save for college, and not everyone can get in on academic or athletic scholarships. Student loans are a now ingrained aspect of becoming a student, which is troublesome to a big degree. It's the students who are the victims of rapidly increasing tuition, and even working full-time before school won't guarantee the necessary money to afford school. Student loans are taken out by hundreds of thousands of students a year, and high interest rates kill their ability to avoid debt. Loans are helping students afford school, but some ask at what cost to the students themselves? Unfortunately, we see the cost is the trillions that are accumulating and are unable to be paid off.

Eating out and drinking

Socializing with others is a fundamental aspect of being a college and university student in the 21st century. It isn't a new idea to use schooling as a means of casual networking and making acquaintances, but rather contemporary is how much it harms student wallets. Ordering takeout for a study session is a normal aspect of school life, so is going out for drinks at the bar, but the surmounting cost that's revealed from this aspect of school life is staggering. Students can spend anywhere from $50-$100 a night on the weekend, which obviously hampers their ability to afford the necessities and gets them into financial trouble. If there's any wisdom to be imparted on these scholars, it would be to learn the skills of cooking and resisting FOMO (fear of missing out) and just stay home every so often.

Buying new clothing and products

This comes down to a personal decision, and it's something that students should know to avoid. With the talk of FOMO, it can be hard to avoid the peer pressure of wanting to keep up with fashion trends and look the part of a real college student. Firstly, it's hard to find your sense of identity, which is partially what higher education is for, but secondly, these new clothes and products cost plenty of money. New laptops cost $1000+, same with smartphones and smart technology, and a designer or name brand clothing isn't cheap, either. Avoiding this pitfall can save students from an added burden of debt.

Not investing or saving

Another part of financial literacy that's sorely lacking for students is their investing and saving skills. This isn't their fault again as financial literacy should be taught as a compulsory course in schools as young as the elementary/primary levels, but it's lacking, nonetheless. Teaching students how they can begin investing in their 20s will show them the potential to build a retirement fund for their later years. The best time to start investing in ETFs, stocks, retirement funds, and build a portfolio was yesterday, and the next best time is today.

Focused on studying and not working

Students need to focus on their studies first and foremost. There's no question about that, but this is a sort of self-fulfilling prophecy. When students are committed as they should be to their education, there's less time to work a part-time job to help cover costs. Again, it would be disingenuous to blame this on their part as they need to study and focus, but not working during schooling gives them fewer chances to earn an income to help soften their debt woes.

Being a student isn't easy. Finding your identity, your passion, meeting new people, improving your knowledge, and studying hard, all while combined with the fear of student debt, are very real stressors. We know that the student debt crisis is reaching critical levels, but these seven reasons show how some of it began from a smaller, more personal level.